Megatrends

Megatrends are the starting point of all thematics and, accordingly, are avenues of growth for capturing thematic alpha.

Why invest in megatrends?

A megatrend is a driving force in human development that unfolds over a long stretch of time within societies, while making profound changes to them. For, the history of mankind is not static but constantly marked by change. Administrative centralisation, rural exodus, and the salarisation of work are well-known examples of underlying trends that have emerged from our modern age.

Just as looking back at past megatrends helps us better understand the world we now live in, identifying current megatrends helps us get a jump on understanding our future.

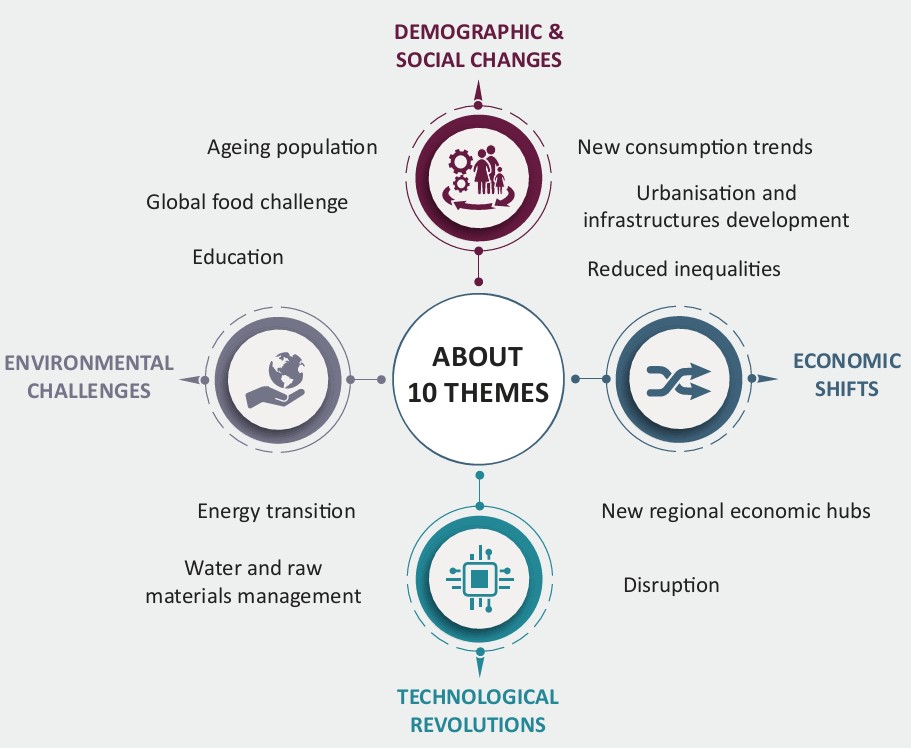

Demographic and social changes, economic shifts, technological revolutions and environmental challenges of our time are occurring at an unheard of pace. Because they require adjustments in all areas and by all of society’s actors – governments, companies and individuals – they point to where value will be created in the near future.

Studying the megatrends of our time accordingly provides a link to the foreseeable future, which can be modelled on the basis of quantified estimates. Among those megatrends that are already plain to see and whose impact can already be quantified are the expanding global population, the emergence of new economic powers, the development of artificial intelligence, and increasingly scarce resources.

The foundation is being laid now for the world of tomorrow

Megatrends are redesigning the world of tomorrow.

Our approach

To wisely exploit these megatrends now, we have developed turnkey investment solutions based on a dynamic allocation of thematic funds managed exclusively by CPR AM. This is what makes the fund managers’ proximity to each thematic a major advantage.

Our Megatrends strategy aims to capture the various drivers of long-term growth arising from these thematics while adjusting fund selection to the short-term market environment.

To fit various risk profiles, we have developed alternative investment solutions to access this thematic:

- Megatrends: a 100%-equity solution for investors seeking to boost a portion of their investment portfolio. It seeks to fully tap into the thematic’s potential through a dynamic allocation of thematic equity funds based on market cycles and the fund managers’ convictions.

- Smart Trends: a multi-asset class solution for investors who are somewhat risk-adverse. These investment thematics are integrated here into a flexible multi-asset class allocation that is able to adjust tactically to risk.

The main risks incurred by this strategy are the risk of loss of capital, equity risk, interest-rate risk, credit risk, and exchange rate risk. To find out more about the fund’s risk profile, please refer to its legal documentation.